You don't have to keep up on everything, yourself.

You have good incomes, live (or want to live) modestly, and seek a lifelong problem-solving and advice partnership, to finally get your finances in order.

Is your financial picture starting to outgrow your capacity (and let’s be frank, your interest) to keep up with all of it?

That’s where I come in, I help you navigate financial transitions (both the ones you plan and the ones that sneak up on you): moving, renting or buying, graduating, children, new jobs, your second job. I know the questions are endless; I’m here to help you through them and shape your financial plan to support all those transitions.

I am a fee-only, comprehensive financial planner that incorporates appreciative life planning to unearth your concerns, transitions and desired future. This is not a one time thing, this is ongoing education, coaching and planning designed to build your emotionally intelligent plan and keep it tuned year round as your life changes – because it will change.

What We Offer

ENOW provides a comprehensive service bundle on a fee-only, flat-fee basis through our Comprehensive Financial Planning program of services, which include: ongoing financial planning, investment management, and investment monitoring for assets held away.

Ongoing Financial Planning

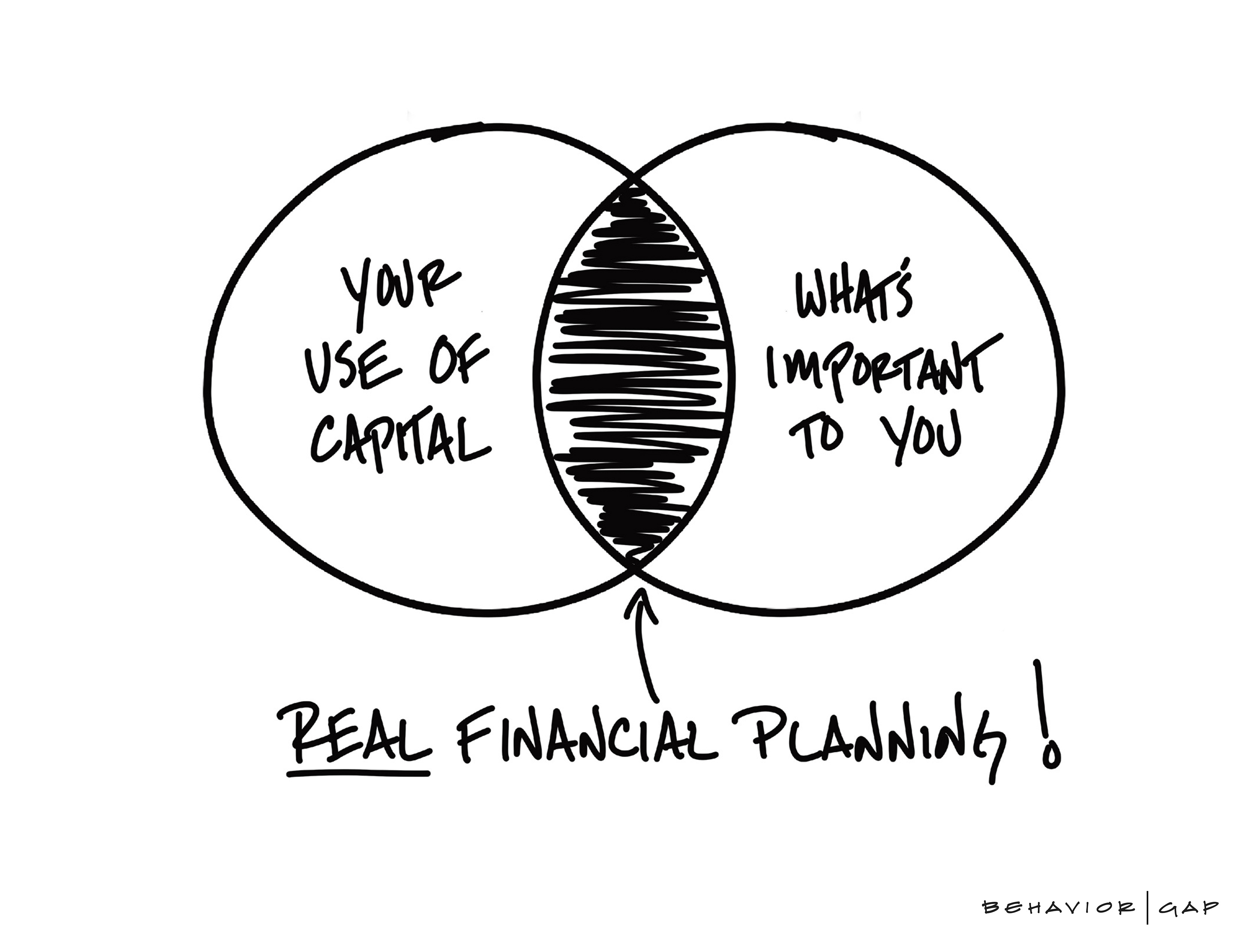

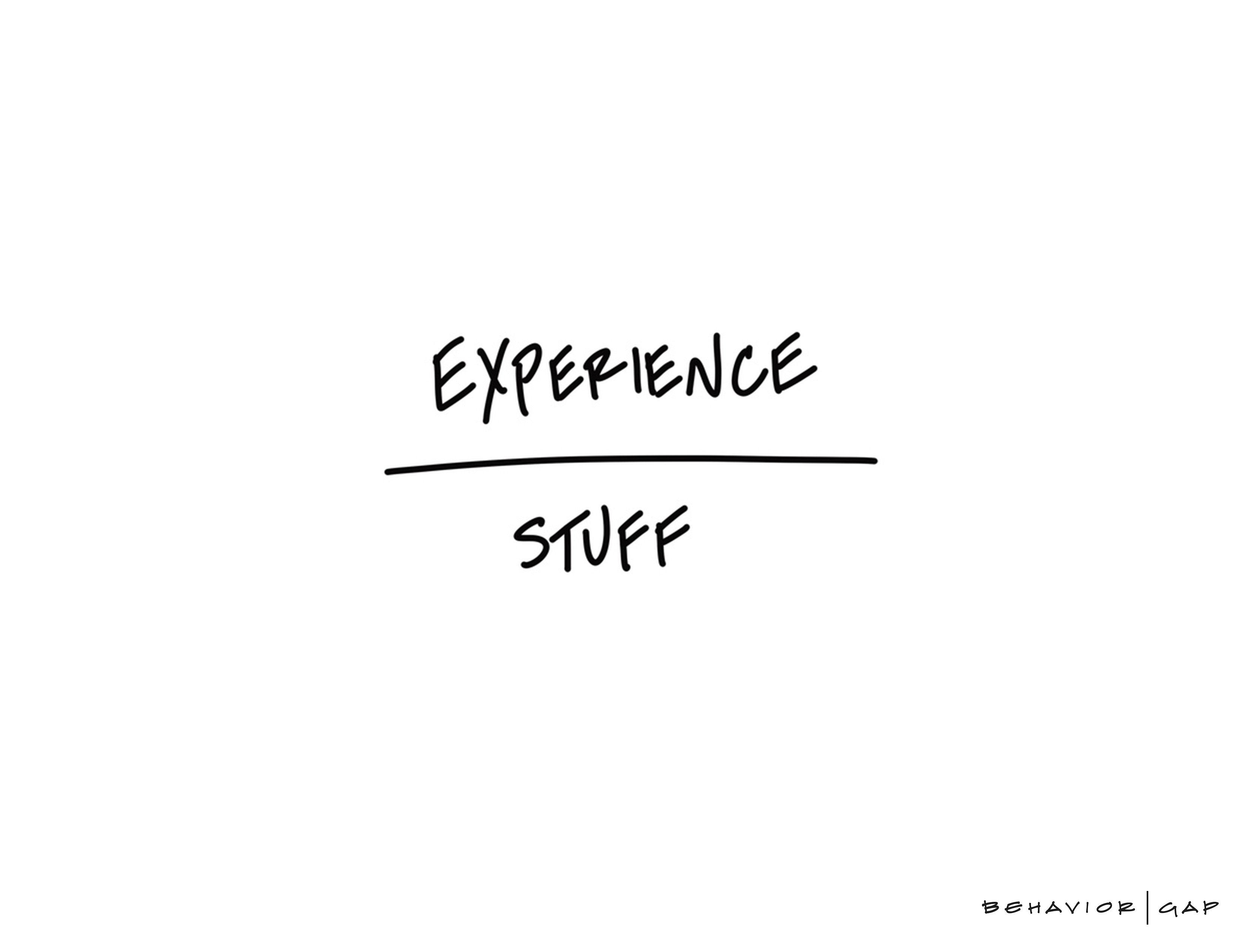

Financial Planning is a collaborative process that helps maximize your potential for meeting your life goals through financial advice that integrates all the relevant elements of your personal and financial circumstances. We work with you continually to develop, implement, monitor and adjust your plan over time; your life changes frequently, your plan needs to adapt accordingly.

Investment Management

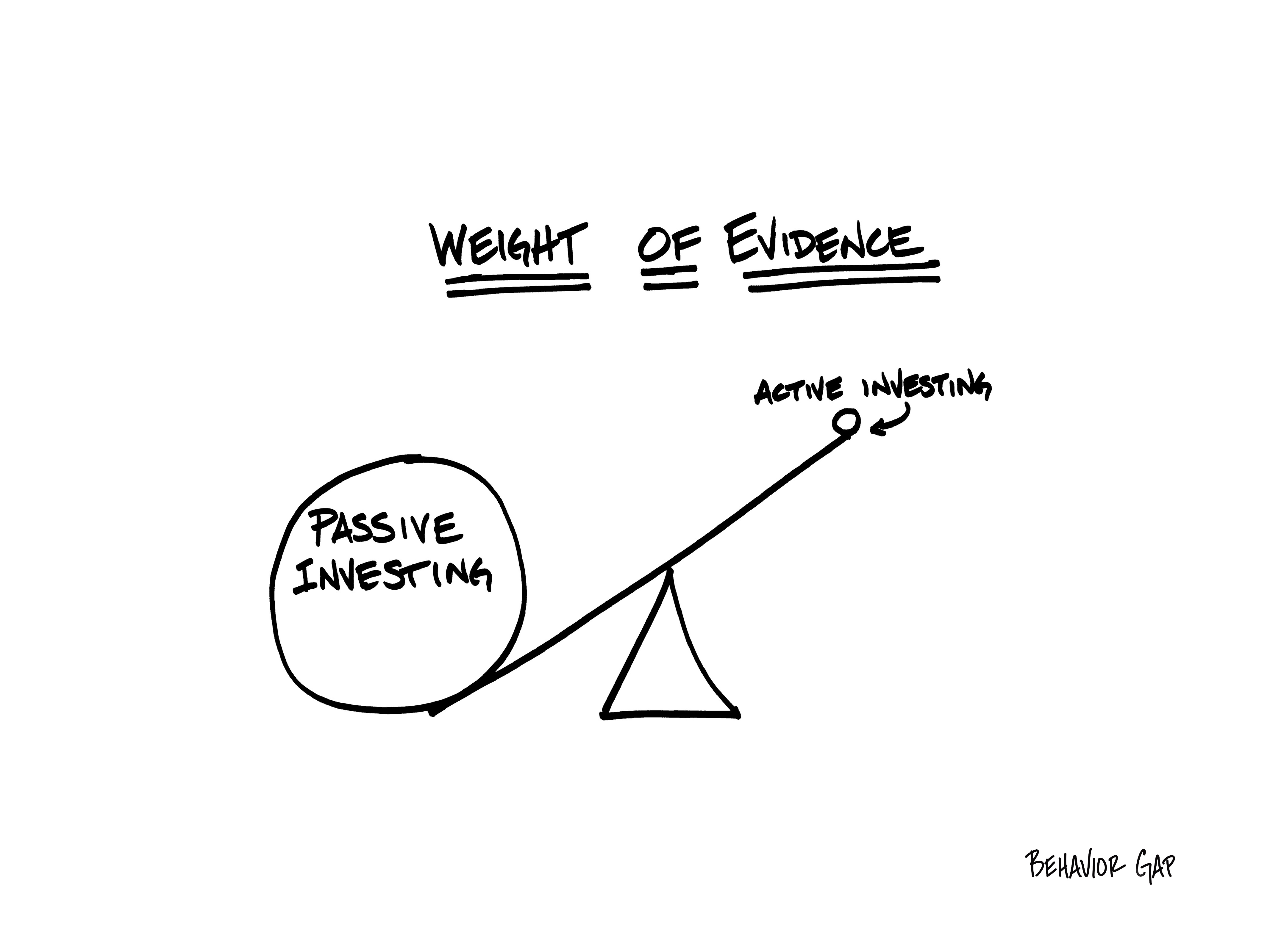

The plan comes first, investing supports it, so we manage your investable assets to enable your plan. Your plan’s needs and objectives produce a personal investment policy (how you want your money invested). We implement that policy using Passive Investing strategies.

If you wish to manage your own investments, we’ll support you in that work.

Investment Monitoring for Assets Held Away

We’ll also help you manage and monitor your “held-away” accounts to align them with your investment policy.

Our Team

Blogs

If you ask me how I'm doing, I usually reply, "never better." Here's why.

First, let’s start by uncovering the most common mistake in estate planning… Surprisingly, this frequently made mistake might already be on your doorstep. A staggering number of people haven’t yet started an estate plan. It’s a critical oversight that can have far-reaching implications, but this isn’t the only pitfall that can disrupt your planning efforts. Here’s a breakdown of 4 estate planning missteps and how to fix them: Mistake #1: Neglecting to Update Your Estate...

How many years will your retirement last? What are the chances you’ll live past 90? Most of us answer those questions wrong because we don’t have strong longevity literacy. 1 That means that about 81% of us aren’t working with a viable understanding of our own life expectancy. Let’s explore how understanding longevity could create a positive impact in your retirement planning. What is longevity literacy? Longevity literacy refers to your knowledge about expected lifespans...